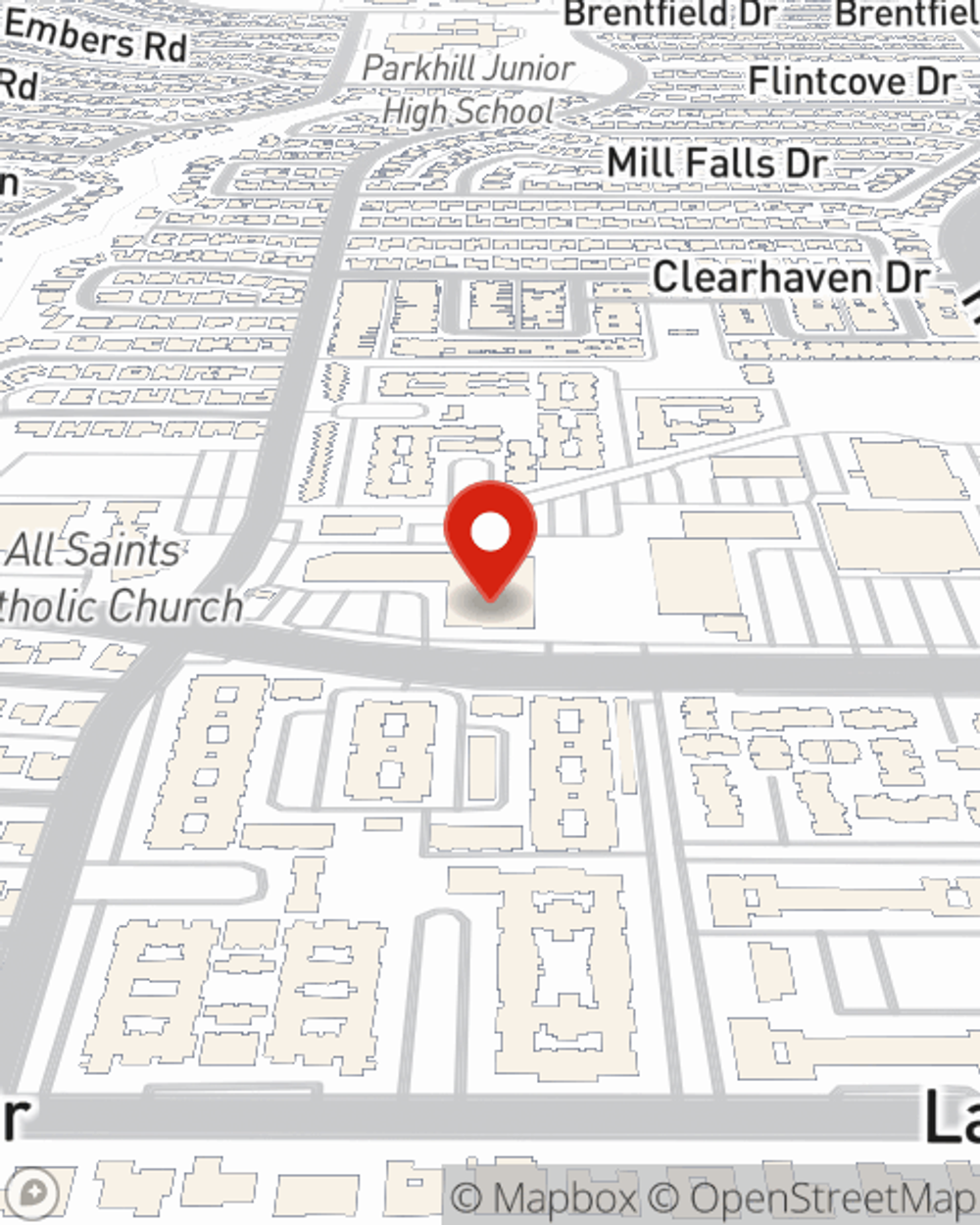

Business Insurance in and around Dallas

One of Dallas’s top choices for small business insurance.

Insure your business, intentionally

- Dallas

- Richardson

- Plano

- Carrollton

- Addison

- Cypress

- Denton

- Gainesville

- Midland

- Fort Stockton

- Farmers Branch

- Garland

- Irving

- University Park

- The Colony

- Allen

- Highland Park

- Frisco

- Rowlett

- Wylie

- Lewisville

- Sanger

- Stephenville

- Mesquite

This Coverage Is Worth It.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Maria Melendez help you learn about great business insurance.

One of Dallas’s top choices for small business insurance.

Insure your business, intentionally

Protect Your Future With State Farm

For your small business, whether it's a funeral home, a tailoring service, a dry cleaner, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like business liability, buildings you own, and extra expense.

Contact the outstanding team at agent Maria Melendez's office to discover the options that may be right for you and your small business.

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Maria Melendez

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.