Renters Insurance in and around Dallas

Renters of Dallas, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Dallas

- Richardson

- Plano

- Carrollton

- Addison

- Cypress

- Denton

- Gainesville

- Midland

- Fort Stockton

- Farmers Branch

- Garland

- Irving

- University Park

- The Colony

- Allen

- Highland Park

- Frisco

- Rowlett

- Wylie

- Lewisville

- Sanger

- Stephenville

- Mesquite

Insure What You Own While You Lease A Home

It may feel like a lot to think through work, your sand volleyball league, your busy schedule, as well as deductibles and coverage options for renters insurance. State Farm offers straightforward assistance and unbelievable coverage for your swing sets, electronics and furnishings in your rented property. When trouble knocks on your door, State Farm can help.

Renters of Dallas, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Open The Door To Renters Insurance With State Farm

Renters often raise the question: Do you really need renters insurance? Think for a moment about how much it would cost to replace your belongings, or even just a few high-cost things. With a State Farm renters policy behind you, you won't be slowed down by fires or break-ins. Renters insurance doesn't stop there! It extends beyond your rental space, covering personal items you've placed in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. As more of your life is online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Maria Melendez can help you add identity theft coverage with monitoring alerts and providing support.

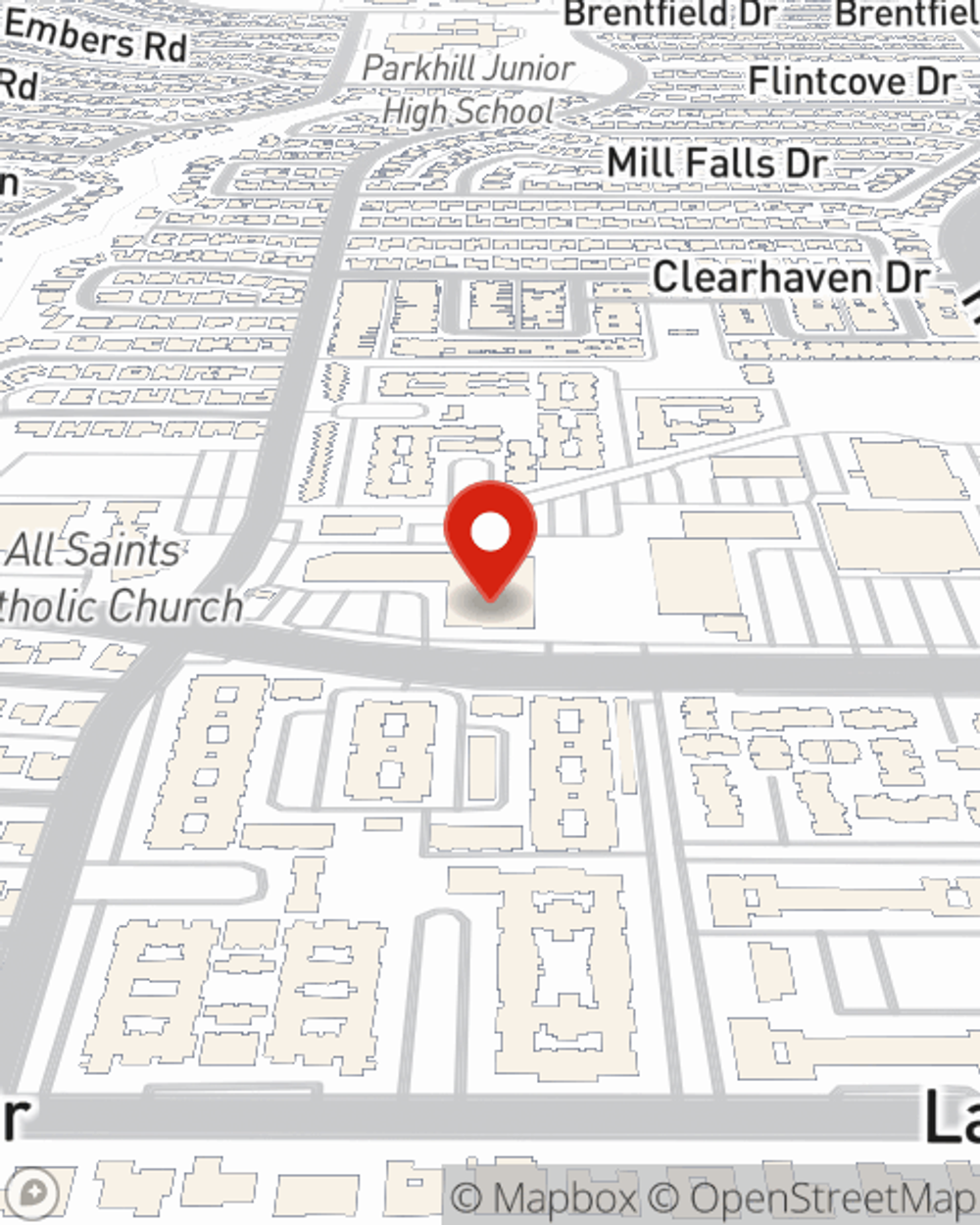

If you're looking for a reliable provider that can help you protect your belongings and save, visit State Farm agent Maria Melendez today.

Have More Questions About Renters Insurance?

Call Maria at (214) 296-2440 or visit our FAQ page.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Maria Melendez

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.